Investing in Australian Real Estate - 2024 Market Projections and Tips

You're about to embark on a journey into the Australian real estate market, a landscape with opportunities and nuances that make it a unique investment destination. The purpose of this blog is to guide you through the 2024 market projections for each Australian capital city, offering you a lens to view potential investments through.

With insights from Ally Property Group, your trusted property investment adviser for Australia, you'll be well-equipped to navigate these waters.

Section 1: The Australian Real Estate Market – An Overview

Historical Performance

To understand where you're going, you need to know where you've been. The Australian property market has a rich history of resilience and growth. Over the past decade, Australia's major cities have seen a fluctuation in property values, with periods of rapid growth followed by stabilisation. For instance, Sydney and Melbourne, the two largest markets, experienced significant price increases up to 2017, followed by a cooling period. However, these markets have shown a strong rebound in recent times, particularly in the wake of global events that reshaped economies worldwide.

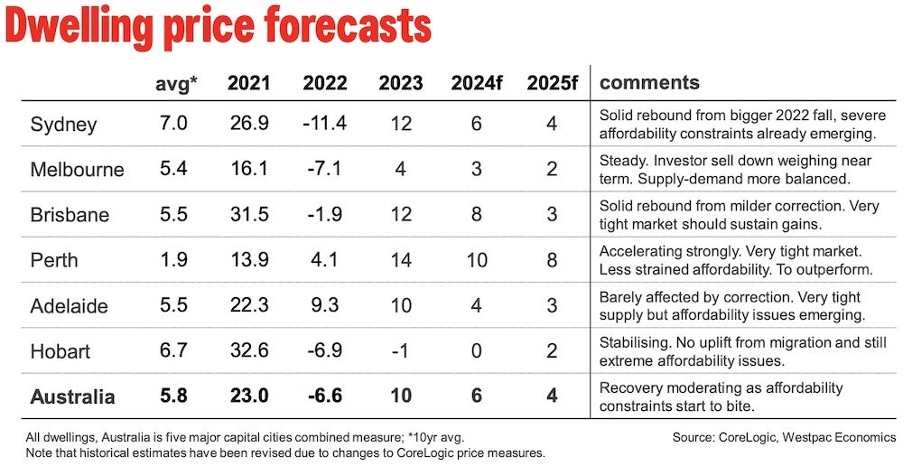

Below is an outline of the historical growth based on a 10 year average. It’s important to note that this represents all dwellings, including both houses and apartments, which not only highlights the historical growth, but also the importance of appropriate asset selection depending on where you’re investing.

Key Influencing Factors

Several factors influence the Australian real estate market. The country's stable political climate, robust economy, and population growth are key drivers. Additionally, factors like interest rates, government policies, and global economic trends play a significant role. For you as an investor, understanding these elements is crucial in making informed decisions.

Recent Trends and Future Projections

The recent trends point towards a maturing market. With the onset of global economic shifts, Australian real estate has shown remarkable resilience. The market is currently experiencing a phase of moderate growth, setting the stage for what's to come in 2024.

Section 2: Capital City Deep Dives

Sydney

Current Market Analysis

Sydney, the crown jewel of Australian real estate, has always been a hotspot for investors. As of 2023, the median property price in Sydney has shown steady growth. The market is characterised by high demand, especially in sought-after suburbs.

Historical Data Trends

Looking back, Sydney's property market has been a rollercoaster ride. The last ten years have seen peaks and troughs, with a remarkable surge in prices up until 2017, followed by a period of adjustment. However, the city's inherent appeal and robust economic fundamentals have ensured a strong market recovery.

Forecast for 2024 and Beyond

For 2024, the projections indicate a stable but positive growth trend in Sydney. The forecast suggests a balanced market, with potential for both capital gains and rental yield improvements. As an investor, you'll find opportunities in both residential and commercial sectors, particularly in emerging suburbs. Sydney is forecast to grow by 6% in 2024, and by 4% in 2025, as the market stabilises following the last few years of significant growth.

Melbourne

Market Overview

Melbourne, known for its cultural vibrance and economic strength, is another prime location for real estate investment. The city has a diverse property market, offering a range of options from bustling city apartments to serene suburban homes.

Analysis of Historical Data

Melbourne's property market mirrored Sydney's to some extent, with significant growth followed by a period of stabilization. However, Melbourne's market is noted for its resilience, bouncing back strongly after downturns.

Predictions for 2024

In 2024, Melbourne is expected to see a healthy growth in property values. The demand for housing in Melbourne's suburbs is likely to increase, driven by a combination of lifestyle factors and affordability. Melbourne is only forecast to grow by 3% in 2024, and 2% in 2025, however it does highlight the importance of asset selection if you’re investing here.

Brisbane

Current Market Conditions

Brisbane offers a different flavour in the Australian property market. Known for its balmy climate and laid-back lifestyle, it's a market that has been steadily growing in appeal.

Review of Past Market Performance

Historically, Brisbane's market has been more stable compared to Sydney and Melbourne, with gradual but consistent growth. This steady performance has been a draw for investors seeking a more predictable market.

Outlook for 2024

Looking ahead to 2024, Brisbane's real estate market is expected to continue its steady growth trajectory. The city's ongoing infrastructure developments and population growth are key factors that will drive the market forward. The market here is forecast to grow by 8% in 2024 and then slow to 3% in 2025.

Adelaide

Analysis of the Current Market

Adelaide, often regarded as a hidden gem in the Australian property landscape, has been gaining attention for its affordability and lifestyle. The city offers a stable market with good long-term prospects.

Historical Data Trends

Adelaide's property market has shown slow and steady growth over the years. This consistent performance has been underpinned by solid economic fundamentals and a balanced supply-demand equation.

Projections for 2024 and Future Trends

For 2024, Adelaide is projected to continue its pattern of stable growth. The market is likely to benefit from ongoing economic development in the city. Adelaide is forecast to grow by 4% in 2024, and by just 3% in 2025.

Perth

Current Market Analysis

Perth's property market stands out for its resilience in the face of economic shifts. Despite the challenges posed by rising interest rates, housing demand in Perth remains robust, buoyed by a persistent shortage of housing stock.

Historical Data Trends

Historically, Perth has weathered various economic cycles, maintaining steady growth and showing strong recovery capabilities. The completion of significant infrastructure projects, such as the Morley-Ellenbrook Line set for 2024, is expected to further stimulate demand.

Forecast for 2024 and Beyond

Looking forward to 2024, the market is predicted to remain active, with particular interest in areas undergoing infrastructural development. By June 2025, median unit prices in Perth are forecasted to reach approximately $459,000, reflecting a continuous positive trend. Perth is forecast to show the strongest growth up 10% in 2024 and slowing to a still very strong 8% in 2025.

Canberra

Current Market Analysis

Canberra exhibits a mixed pattern in its property market, with the apartment sector showing growth, while some areas experience price declines. The market's variation across different suburbs underscores the need for localized investment strategies.

Historical Data Trends

The market in Canberra has displayed stability, supported by a strong public sector, which anchors the city's economic base. This stability provides a buffer against market fluctuations seen in other cities.

Forecast for 2024 and Beyond

As we move into 2024, Canberra's property market is expected to maintain its overall stability. Investors should focus on understanding the unique dynamics of different suburbs to identify growth opportunities. Canberra is forecast to grow by 4.5% in 2024, and by 3.5% in 2025.

Darwin

Current Market Analysis

Darwin's real estate market is characterised by its dynamism, with notable fluctuations in property values. Recent trends indicate a downturn in some areas, but signs of recovery are emerging.

Historical Data Trends

The median dwelling price in Darwin saw a slight decrease in the 2022-23 financial year. Despite these fluctuations, the market has shown resilience and is expected to stabilize.

Forecast for 2024 and Beyond

For investors considering Darwin in 2024, it's important to be prepared for potentially higher risk-reward scenarios. The market is poised for stabilisation, presenting opportunities for discerning investors. Darwin is expected to grow by 2% in both 2024 and 2025.

Hobart

Current Market Analysis

Hobart's property market, after experiencing significant growth, has recently seen a downturn. Nonetheless, its appeal remains high due to its lifestyle and affordability.

Historical Data Trends

Hobart's growth trend has been notable in recent years, making it a focal point for investors looking for a blend of lifestyle and investment potential.

Forecast for 2024 and Beyond

Looking ahead to 2024, Hobart's market is expected to continue its path towards recovery, with a particular focus on more affordable housing. This positions Hobart as an attractive option for a wide range of investors. Hobart is expected to remain flat in 2024, and to grow by 2% in 2025.

Wrapping Up

As we approach 2024, the Australian property market shows diverse opportunities across its major cities. Each city presents unique characteristics, from Perth's consistent growth to Darwin's dynamic market. Your investment strategy should be tailored to the specific dynamics of each city, considering factors like historical performance, current market conditions, and future growth projections.

If you're ready to explore the potential of the 2024 Australian real estate market across these diverse cities, remember the importance of informed decision-making. For personalised advice and guidance on investing in these markets, consider reaching out to Ally Property Group or other real estate professionals who can provide insights tailored to your investment goals.

Embark on your property investment journey with Ally Property Group, your trusted ally in Australia's real estate market. Our expert advisers are dedicated to crafting personalised investment strategies for Australian expats and residents alike, aiming to enhance your portfolio and maximise returns. Start building your wealth with Ally Property Group, where strategic insights, analysis and modelling leads to prosperous investments.

We’re more than just property advisers. As Australian expats ourselves, we've navigated the intricate world of property investment both at home and abroad. With a legacy rooted in financial services, we offer a holistic, transparent, and strategic approach, ensuring you're equipped with the knowledge and confidence to make informed decisions.

Book an obligation-free, complimentary consultation here today.

General Information Warning: The information contained herein is of a general nature only and does not constitute in any way, personal advice. You should not act on any recommendation without considering your personal needs, circumstances, and objectives. We recommend you obtain professional property investment advice specific to your circumstances.

Pay it forward! Share this article with your friends and network.